(Bloomberg) — Hedge funds went massively short on Tesla Inc. (TSLA) just before the electric vehicle maker released a series of numbers that sent its stock soaring.

Most read from Bloomberg

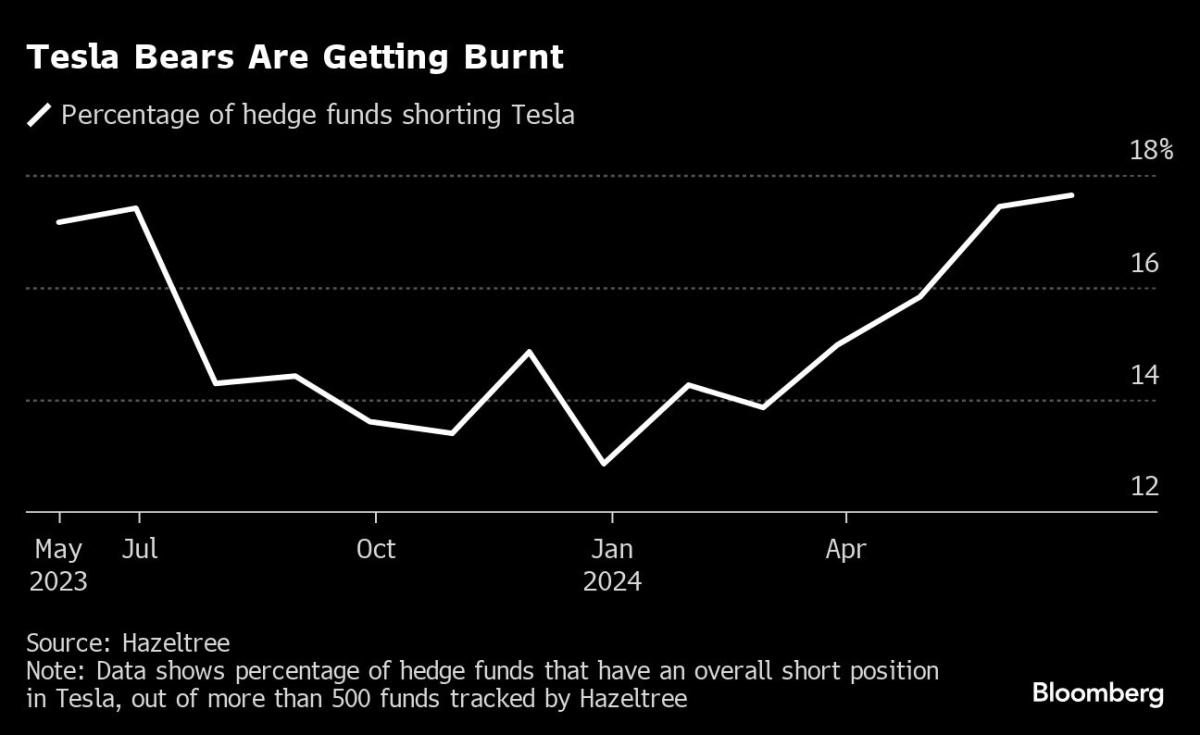

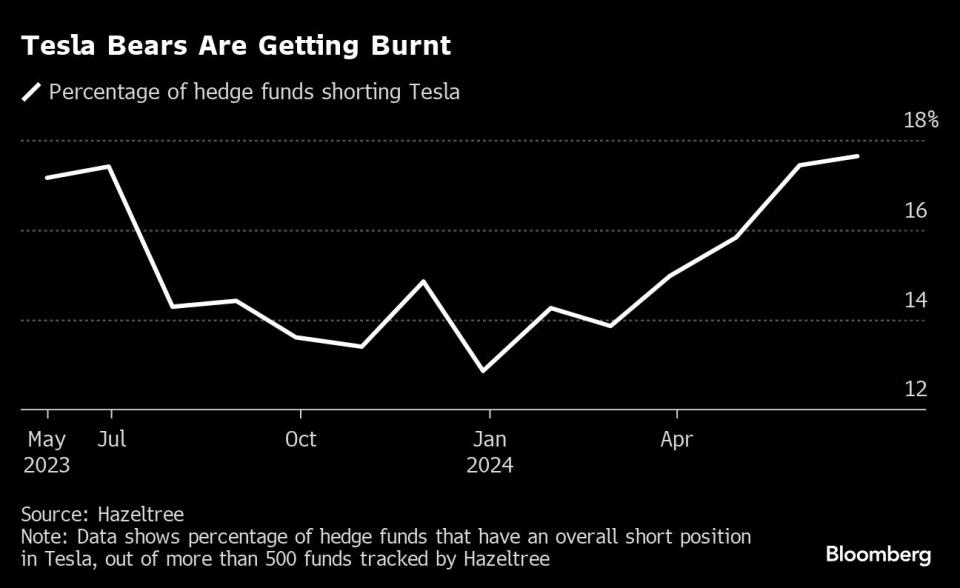

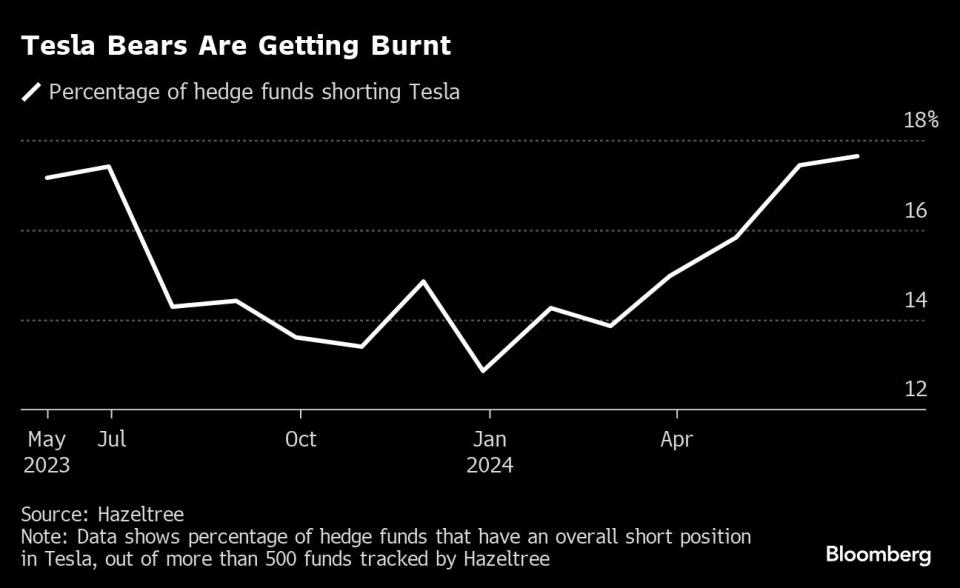

About 18% of the 500+ hedge funds tracked by data provider Hazeltree had an overall short position in Tesla at the end of June, the highest percentage in more than a year, according to figures shared with Bloomberg. That compares with just under 15% at the end of March.

Those contrarian bets now threaten to saddle the hedge funds behind them with losses. Tesla’s latest vehicle sales results, released on July 2, revealed second-quarter deliveries that beat analysts’ average estimates, even as sales fell. Investors jumped on the news, driving the company’s shares to a six-month high. Tesla’s stock price is now up about 40% since early June.

Tesla is likely to see improved profit margins, helped by lower production and raw material costs, according to Seth Goldstein of Morningstar Inc., one of the three largest analysts covering the stock in a Bloomberg ranking that tracks price recommendations.

The company will likely “return to profit growth” next year, he said in a note to clients. But how Tesla handles the market’s increasing focus on affordable electric vehicles will be crucial, he added.

The development fuels a continuing sense of uncertainty over how to handle the broader EV market, amid a sea of conflicting dynamics. The industry — a key part of the global race to achieve net-zero emissions by 2050 — enjoys generous tax breaks. Yet it also faces significant obstacles in the form of tariff wars and even identity politics, with some consumers dismissing EVs as a form of “woke” transportation.

In the US, Donald Trump has said that if he runs again after the November election, he will roll back existing laws supporting battery-powered vehicles, calling them “crazy.” That said, Trump is a “big fan” of Tesla’s Cybertruck, according to the EV giant’s CEO Elon Musk.

Meanwhile, the list of internal disruptions at Tesla is long. In April, Musk told employees to brace for major layoffs, including sales roles. And the Cybertruck, Tesla’s first new consumer model in years, has gotten off to a slow start.

For that reason, some hedge fund managers have decided the stock is off-limits altogether. Tesla is “very difficult for us to position,” said Fabio Pecce, chief investment officer at Ambienta, where he manages $700 million, including the Ambienta x Alpha hedge fund.

According to him, it is not clear in principle whether investors are dealing with “a top company with a great management team” or whether it is “a franchise with a challenge and poor corporate governance”.

However, “if Trump wins, it will be really positive” for Tesla, though “clearly not great for EVs and renewables in general,” he said. That’s because Trump is expected to impose “huge tariffs on the Chinese players,” which would be “beneficial” for Tesla, Pecce said.

Investors ended 2023 saying they were likely to pull back further from green stocks in general and EVs in particular, according to a Bloomberg Markets Live Pulse survey. Nearly two-thirds of the 620 respondents said they planned to stay away from the EV sector, with almost 60% expecting the iShares Global Clean Energy exchange-traded fund to continue its slide in 2024. The ETF has fallen 13% so far this year after falling more than 20% in 2023.

The Bloomberg Electric Vehicles Price Return Index, which includes BYD Co., Tesla and Rivian (RIVN) Automotive Inc., has fallen about 22% so far in 2024. At the same time, the metals and minerals needed to produce batteries are at the whim of highly volatile commodity markets, with speculators regularly trying to make a quick buck from shifts in supply and demand. Price volatility means some battery makers are having to adapt to a market where their profit margins are being severely squeezed.

Against that backdrop, more traditional automakers are under pressure from shareholders to slow their capital spending on electric vehicles, with recent examples including Porsche AG. Polestar Automotive Holding UK Plc (PSNY), a high-end EV maker, has lost nearly 95% of its value since it was spun off from Volvo Car AB two years ago. Fisker Inc., another luxury EV maker, has seen its value wiped out starting last year and has since filed for Chapter 11 bankruptcy protection.

Soren Aandahl, founder and CIO of Texas-based Blue Orca Capital, said “valuations in the EV sector are so bad” that he’s now avoiding shorting the sector. It’s no longer an obvious contrarian bet, as those tend to do best when investors “get in when things are a little bit higher,” he said. But at this point, “a lot of the air has gone out of the balloon.”

But Eirik Hogner, deputy portfolio manager at the $2.7 billion hedge fund Clean Energy Transition, suggests there could be more pain to come for the broader EV industry. There are still “far too many” startups that are “underscale” and with gross margins that are simply “too low,” he said. As a result, the demand-supply dynamics of the EV market are “still very negative.”

“Ultimately, I think we need to see more bankruptcies” before the market starts to look healthier, Hogner said.

—With assistance from Craig Trudell.

Most read from Bloomberg Businessweek

©2024 Bloomberg LP