- Binance published the proof of reserves, which showed positive growth.

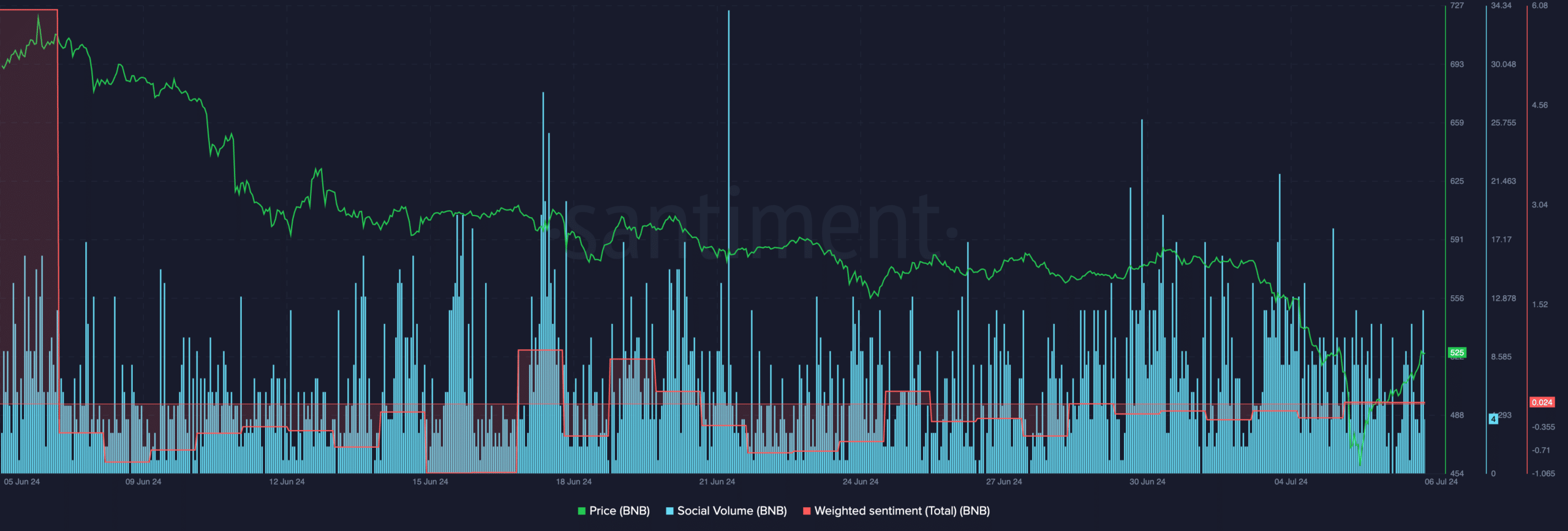

- The social volume and sentiment surrounding the BNB token has decreased significantly in recent days.

Binance [BNB] has endured a series of lawsuits and scrutiny over the past year. Despite the issues Binance faced, the overall health of the exchange remained positive.

The proof is in the pudding

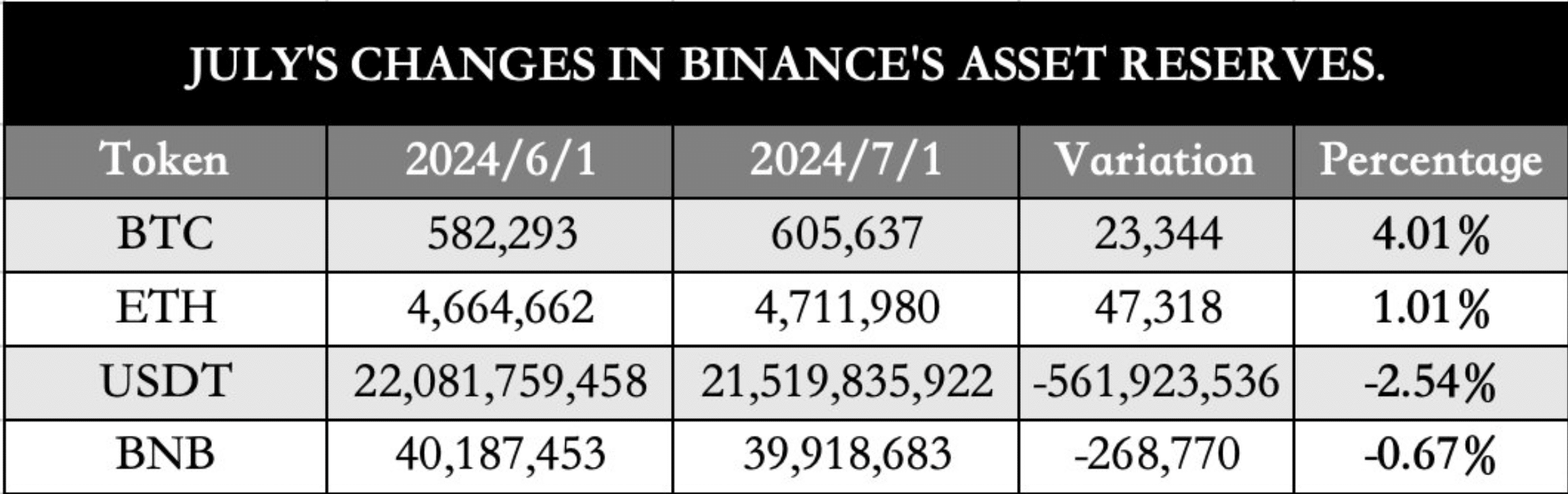

Binance recently released its latest, 20th proof of reserves report. The report details the cryptocurrency holdings of its users and provides transparency into the financial health of the exchange.

Looking at the distribution of user assets, we see a positive trend in Bitcoin holdings. User BTC assets reached 605,637, which represents a 4.01% increase compared to June 1st.

Ethereum holdings also saw a slight increase of 1.01%, with users’ ETH holdings reaching 4.711 million.

However, there was a decline in holdings for Tether (USDT). User USDT assets fell to 21.51 billion, representing a 2.54% decrease from the previous month.

Regular publication of proof of reserves reports builds trust with users by demonstrating solvency and the safe storage of their assets. This transparency can attract new users and encourage existing users to hold larger amounts of crypto on the platform.

Source: Binance

Problems abroad

However, Binance faced a number of issues that could pose problems for the exchange.

Olubukola Akinwumi, the deputy managing director of the Central Bank of Nigeria (CBN), made serious allegations against Binance.

According to local media, Akinwumi accused the crypto exchange of conducting financial transactions normally reserved for licensed banks and institutions.

Akinwumi’s testimony went beyond the money laundering allegations. He specifically pointed out that Binance allows users in Nigeria to make transactions while hiding behind pseudonyms.

According to Akinwumi, this is a direct violation of CBN regulations. The central bank requires all parties involved in financial transactions to disclose their true identity.

Further concerns were raised about Binance’s peer-to-peer (P2P) platform, which facilitates direct transactions between users. Akinwumi stressed that these transactions involve the transfer of Nigeria’s fiat currency, the Naira.

Read Binance Coin’s [BNB] Price Prediction 2024-25

These factors could affect the image and reputation of the Binance exchange, which could even have negative consequences for the BNB token. At the time of writing, BNB was trading at $509.71 and its price had dropped by 0.73% in the past 24 hours.

Social volume surrounding the token increased significantly, but weighted sentiment decreased, indicating a growing number of negative comments surrounding the BNB token.

Source: Santiment