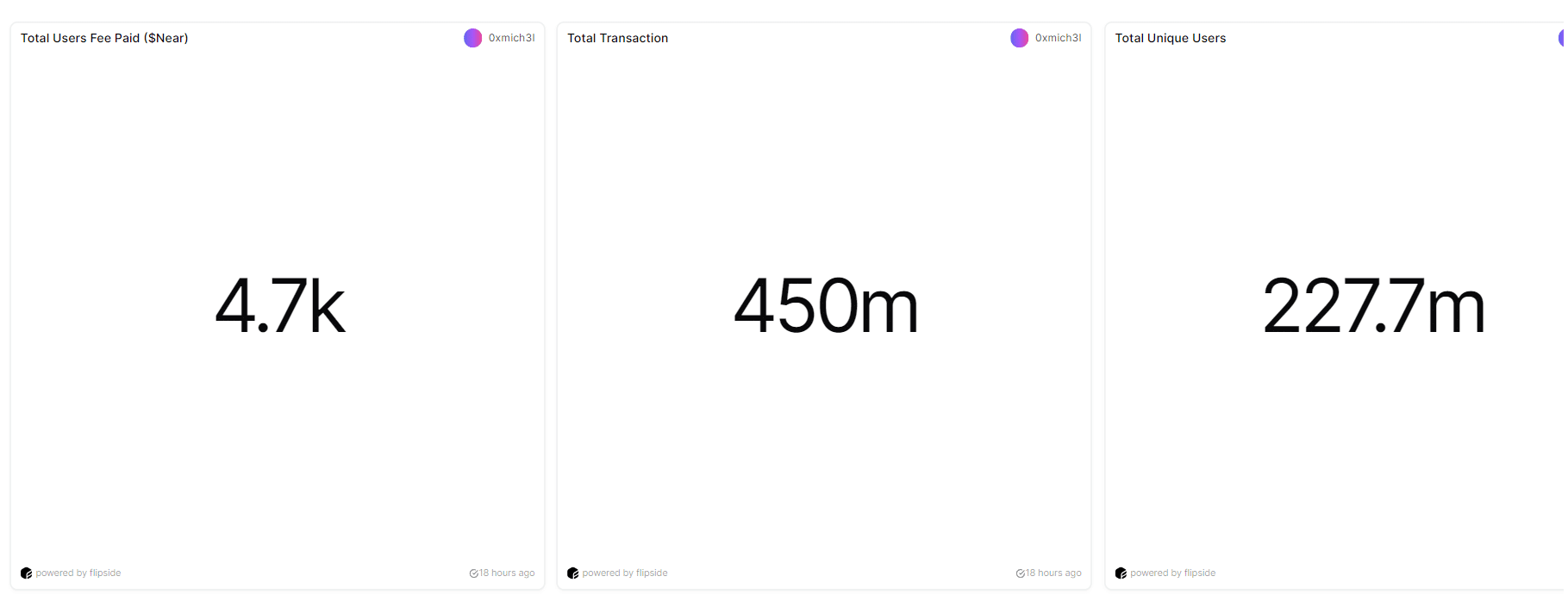

- NEAR Protocol has recorded 450 million transactions and 12.3 million unique addresses.

- Increased user engagement has changed market sentiment

NEAR Protocol has caught the attention of the wider crypto community after a massive increase in transactions and new addresses.

According to an analyst, NEAR addresses have been increasing over the past two months. Masi reported these developments on X (formerly Twitter), stating that,

”In June, @NEARProtocol ranked first among popular chains in the number of active addresses (16.9 million). Ranked first in low cost (

Accordingly, Flipside’s official X-page also reported the rapid growth that NEAR is experiencing. They announced,

“New users on @NEARProtocol have outpaced all other top chains’ growth rates over the past year. NEAR now ranks second in total new users since the start of 2023.”

Source: Flipside

The increase in transactions and address activity has allowed NEAR prices to recover from recent losses.

With higher engagements, bulls are pushing to overcome resistance. This led to 450 million total transactions and 227.7 million unique users. In June, NEAR attracted 12.3 million new addresses and 5.8 million in May.

What drives user engagement?

Several factors have played a crucial role in the increased acceptance and use. First, the development of the NEAR AI R&D Lab is aimed at promoting simple, safe and scalable technology.

The promising potential of AI has played a crucial role in attracting users and positioning NEAR as a key player in the integration of AI and blockchain.

In addition, NEAR Protocol has other innovations, such as chain signatures and the integration of HERE wallet. These developments and integrations have helped NEAR to improve the user experience and make it accessible to many users.

What is the impact on price charts?

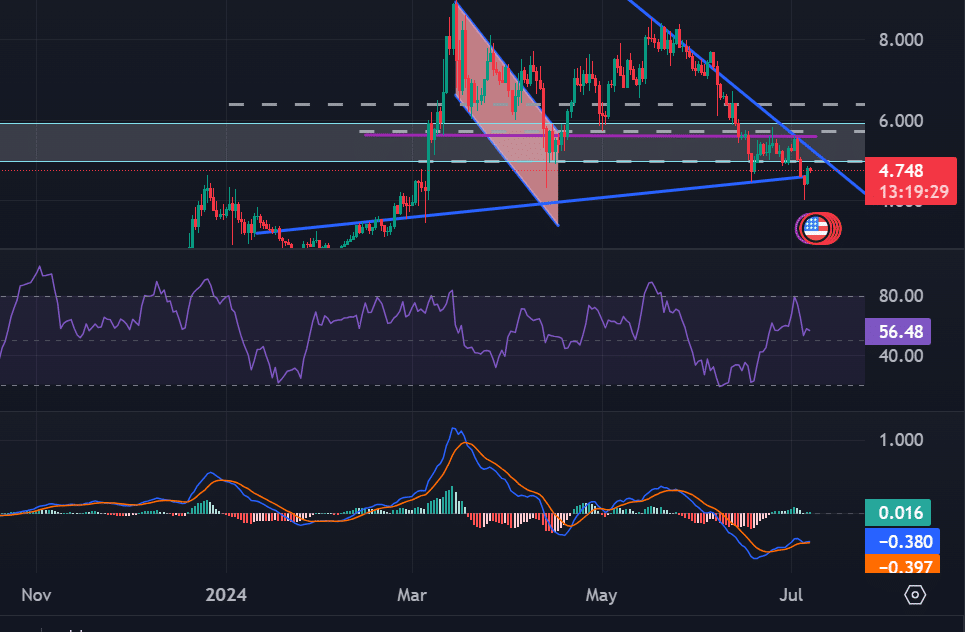

At the time of writing, NEAR is trading at $4.74 after a 5.27% increase in 24 hours. During the same period, trading volume has decreased by 51.75%.

AMBCrypto’s analysis shows that the near-bearish trend is weakening, suggesting a potential reversal.

Looking at the Money Flow Index, it stands at 56 at the time of writing. This MFI suggests that more money is flowing into the altcoin than out of it. While muted, this implies an increase in buying pressure with crypto funds rising.

Source: Tradingview

Similarly, the MACD shows a potential reversal. The MACD histogram is above zero at 0.016, while the MACD line is above the signal line. This shows that the bearish momentum is weakening, which usually follows a bullish trend reversal.

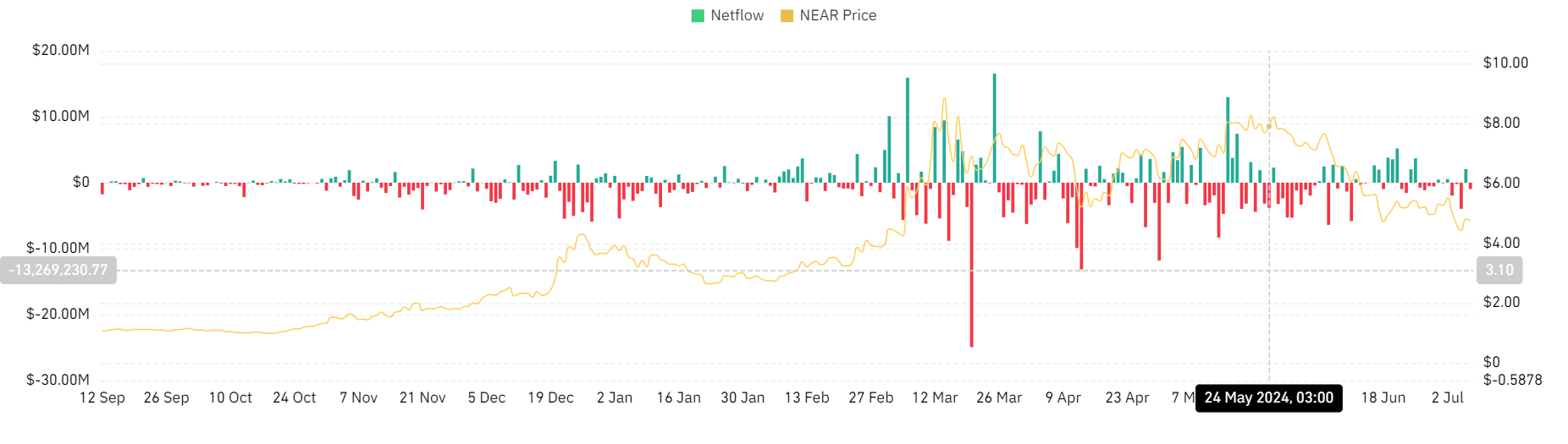

Source: Coinglass

Finally, our coinglass analysis shows that NEAR’s net flow has been mostly negative over the past 7 days. At the time of writing, the net flow is -$940.42k.

A negative value indicates that investors plan to hold the altcoin for the long term, indicating confidence in the altcoin’s future potential.

Is NEAR ready for an uptrend?

NEAR is down 5.56% on weekly charts. If the downtrend continues, it will drop to the next support level around $4.15.

However, if large transactions and more active addresses have a positive effect on the price movements and the market experiences a reversal, prices will attempt to reach the previous resistance level around $5,602.