Halfway through the year and four years into the recession sparked by the coronavirus pandemic, the U.S. jobs engine is still running, even as signs of slowing growth mount.

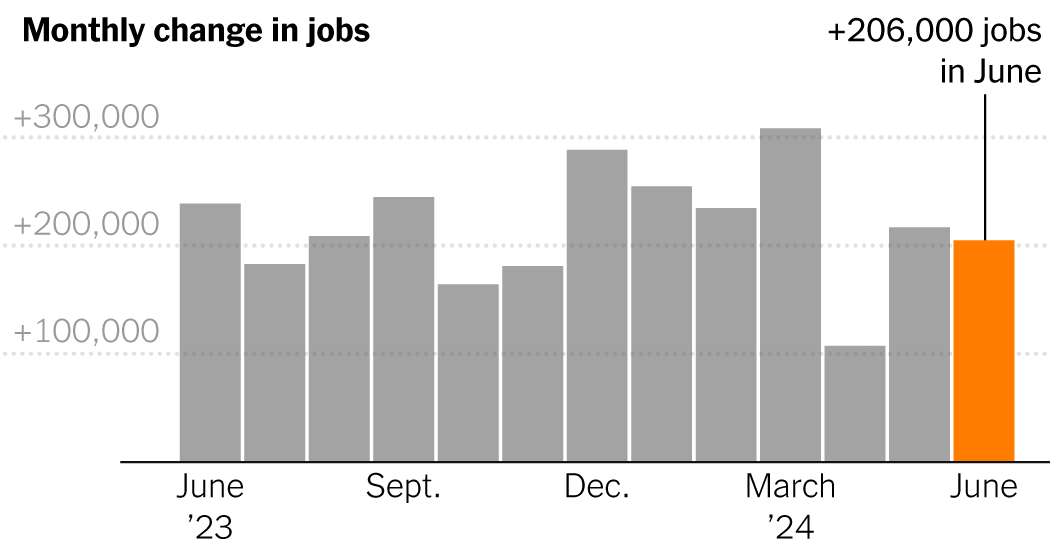

Employers had another solid month of hiring in June, the Labor Department reported Friday, adding 206,000 jobs, the 42nd straight month of job growth.

At the same time, the unemployment rate rose by a tenth of a point to 4.1 percent, up from 4 percent, exceeding 4 percent for the first time since November 2021.

The gain in jobs was slightly larger than most analysts had predicted. But the previous two months’ totals were revised down and the rise in unemployment was unexpected. That has caused many economists and investors to switch from full confidence in the labor market to some concern about it.

“These are good numbers,” said Claudia Sahm, chief economist at New Century Advisors, who warned against overly negative interpretations of the report.

But “the importance of the unemployment rate is that it can tell us something about where we’re going,” she added, noting that the rate has been rising since hitting a low of 3.4 percent early last year.

Wage growth has also been muted. Average hourly earnings rose 0.3 percent in June from the previous month and 3.9 percent from a year earlier, compared with a 4.1 percent year-on-year change in May. But good news for workers: Wage growth has outpaced inflation for about a year.

Markets reacted mutedly to the report on Friday, with stocks rising slightly. Treasury yields fell, however, reflecting growing confidence among traders that the Federal Reserve will begin cutting interest rates.

The benchmark interest rate, which was near zero at the start of 2022, has now been above 5 percent for more than a year as the Fed tries to get a handle on inflation. The impact on lending across the economy has lasted longer than many businesses — or households looking to buy homes or cars — had anticipated.

Most economists expect a further slowdown in job and wage growth until the Fed takes action to ease credit standards. There is growing evidence of a slowdown.

Layoffs are near historic lows, but an indicator known as the hiring rate (the number of hires per month as a percentage of total employment) — has fallen significantly. This means that the relatively few people who lose their jobs generally have more difficulty finding new opportunities.

About three-quarters of the job gains in the June report came from health care, social assistance and government. A few other industries produced scant growth, and some, including manufacturing and retail trade, lost jobs overall.

Much of the government hiring is part of a long-awaited catch-up effort by state and local governments, which have complained of understaffing and only recently reached their pre-pandemic employment peaks. And the aging of the U.S. population has created continued high demand for health care workers and other caregiving work.

However, economists tend to be more reassured when most of the employment growth comes from sectors where the private sector is more dynamic.

“The number of vacancies is declining,” said Nick Bunker, director of economic research at the recruitment site Indeed.

This could partly explain why the number of long-term unemployed (people who have been out of work for 27 weeks or more) is now above the 2017-2019 average.

With inflation running at 2.6 percent, not far from the Fed’s 2 percent target, some analysts worry that the central bank’s current stance could upend the labor market. Fed officials have signaled in the past month that they would respond to a sudden weakening labor market by cutting interest rates, which are currently at multi-decade highs.

Policymakers at the Fed are scheduled to meet later this month and again in September to set interest rate policy. Some investors and financial analysts reacted to the June jobs numbers, saying officials should not wait too long.

“Labor market conditions are cooling,” said Neil Dutta, chief economics research officer at Renaissance Macro Research, a financial services firm. “The tradeoffs for the Fed have changed. If they don’t cut this month, they need to send a strong signal that they’re going to cut in September.”

While the financial world waits for the next move, American households have continued to spend money at a healthy, if somewhat subdued, pace. Over the past month, the Transportation Security Administration screened a record number of travelers at airports. Recent corporate earnings suggest that consumers, while more discriminating than ever before, remain in good shape overall. Since the beginning of the year, the stock market has reached new highs, returning an impressive 17 percent.

In many ways, the financial picture for American households is brighter than it was before the pandemic. At the end of 2019, U.S. households held about $980 billion in “checkable deposits” — the sum of cash held in checking, savings and money market accounts. Now the figure stands at more than $4 trillion.

While that wealth is concentrated at the top of the pack, the wealth and income gains have been widespread. The net worth of the bottom 50 percent of households, about $1.9 trillion on the eve of the pandemic, is now about $3.8 trillion. And for non-managerial workers—roughly eight in 10 people in the labor force—wage growth has been much stronger than the overall average.

For private companies with fewer resources than large corporations, the past four years have at times presented a sickening roller coaster of challenges. Such was the case for brothers Mazen and Afif Baltagi, who own several hospitality businesses in the Houston area — an event space, a sports bar and a couple of cafes — along with a few investment partners.

The rush is not what it was in 2021 and 2022, when people were more euphoric about spending. And “it’s not an easy business,” Mazen Baltagi said, especially as food, labor and construction costs have risen and largely remained high.

Yet from his point of view, it’s “Texas on the rise.”

In this interest rate environment, “banks aren’t really lending to restaurants right now,” he added, but he said he and his brother worked around that and generated enough revenue — and from new capital partners — to be able to undertake future expansions.

That combination of corporate adaptability and profitability is an example of the forces that helped the United States avoid the recession that many experts expected. But surveys of business leaders suggest that many are waiting for the cost of credit to fall before launching new waves of hiring or capital investment.

Now, the question seems to be whether the Fed will cut rates in time to keep the expansion going. Additional consumer price data reports will be crucial as the summer progresses.

Financial markets “just need the inflation data to go with it,” said Samuel Rines, an economist and macro strategist at WisdomTree, an asset manager. “Then the game is on.”